Equity Strategy

Our goal is to identify companies entering a period of earnings acceleration where we can benefit from both the earnings growth rate and multiple expansion.

Diverse Client Base

Including a significant representation in Taft-Hartley Funds, Institutional (Public, Endowments and Foundations, Religious and Charitable), and broker sponsored wrap programs at several of the largest money management firms in the world.

Fixed Income Strategy

Our fixed income strategy utilizes, under the umbrella of current income, a relative valuation strategy amid and among sector, maturity, quality grade, and issues to deploy an investment grade portfolio versus a client selected benchmark.

Long-term Track Records

Equity and fixed strategies created by the Company’s portfolio managers with a consistent management approach. We have over thirty years experience managing client portfolios.

Investment Management Team

Craig Steinberg, Bob Ruland, and Matt Ward comprise the Equity Investment team. Fixed Income Portfolio Managers Joe Sileo, Jerry Thunelius, and Bob Ohanesian lead the Fixed Income strategies.

Experienced Marketing Team

The Institutional marketing team has a primary focus of assisting the unique needs of Taft-Hartley funds. The broker sponsored wrap team strives to assist financial advisors grow their business and provide hands-on training and marketing support to the branch offices throughout the country.

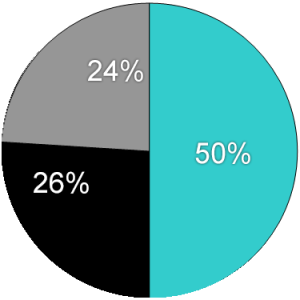

Firm Assets

$8.0 billion

as of 3/31/24

Includes assets managed under certain unified asset management programs some of which the Company has discretion.

ADDITIONAL INFORMATION

Registration with the Securities and Exchange Commission (SEC) does not imply that the SEC or other agency recommends or approves Atalanta Sosnoff.